State of LTE Advanced

In the fast paced world of technology, we just may be in the midst of a summer to remember with the complete hysteria over Pokémon Go, and the growing use of Facebook Live streaming. What will be interesting to watch on the wireless front is if the cellular networks are ready for another inevitable signaling storm, and a spike in mobile data consumption. As we approach this year’s mid mark, let’s review the current state of LTE in our home market of New York City, addressing existing conditions and both challenges and opportunities to come.

In our previous article “5G, The Long Road Ahead”, we mentioned that 5G standardization is expected no earlier than 2020, however, operators can now take steps using existing spectrum assets and equipment that would greatly improve spectral efficiency of their networks, therefore enhancing the quality of the user experience.

We are very excited to begin collaborating with Rohde & Schwarz, one of the world’s largest manufacturers of electronic test and measurement equipment. Rohde & Schwarz provided CMW500 test platform, R&S TS7124 RF Shielded Box equipped with Vivaldi antennas ensuring reliable and reproducible over-the-air MIMO measurements and engineering support. In addition, Rohde & Schwarz supplied us with QualiPoc Android for mobile network testing, which will enable us to perform independent analysis of commercial LTE networks.

F

Densification

On the densification front, Verizon has seemingly been by far the most active, adding hundreds of Small Cells and increasing overall capacity. This seems like a necessary step at least in our market, considering the turn of events during the recent AWS-3 spectrum auction and Verizon’s previous macro site spacing. But credit should be given where credit is due, Verizon has been very active densifying the network.

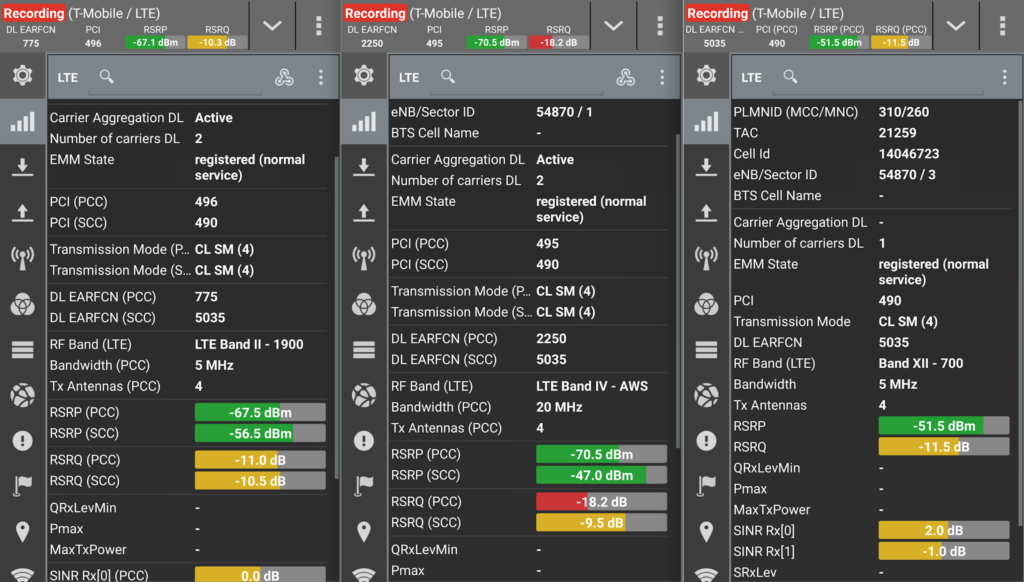

For the longest time, T-Mobile only had mid-band assets in their spectrum portfolio which forced to build a very dense GSM network. Essentially, they have already densified their network more than a decade ago, and are now reaping the benefits. Dense grid coupled with scalable fiber backhaul and the latest RAN from Ericsson allows for a very compelling user experience across the New York City market.

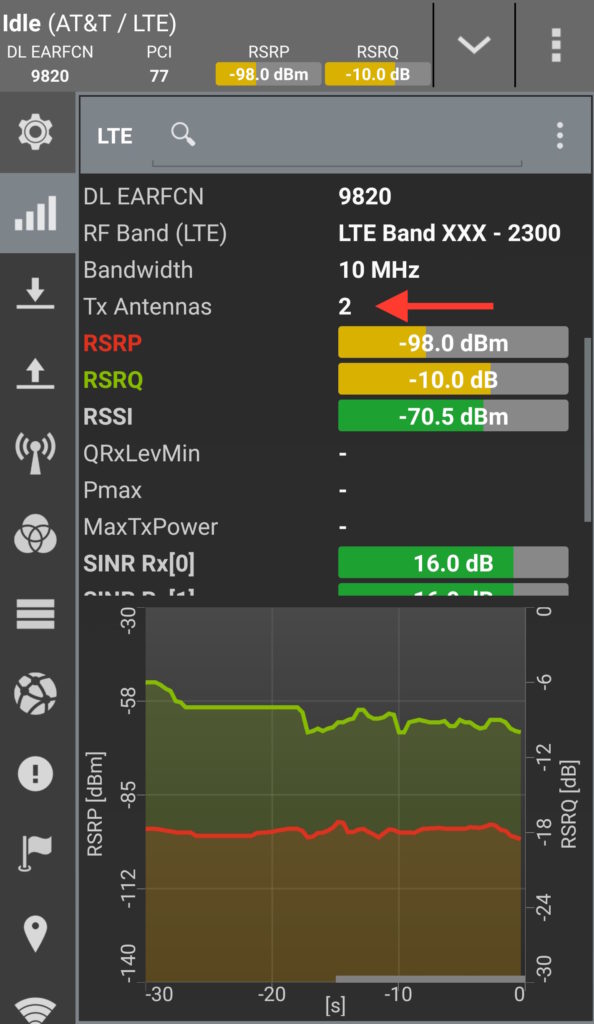

AT&T has taken a different approach. Only a few years ago, AT&T had the fastest LTE network in New York City, but after their 2014 decision to virtually freeze the wireless infrastructure spending and shift the resources to DirecTV and Iusacell acquisitions, they’ve allowed the network to leave a lot to be desired across many key areas of Manhattan. They’ve kept WCS 2.3GHz spectrum unused for more than two years, and overlay can’t come any sooner which will hopefully address the obvious capacity issues they’ve been facing. Additionally, 700MHz Supplemental Downlink D+E blocks are also starting to make its appearance in the most unexpected locations and at a very slow pace. Interference related issues could be preventing AT&T from a more aggressive SDL 700MHz rollout, but it’s worth noting that Band 30 and Band 29 capable devices have been seeded to market for well over a year now.

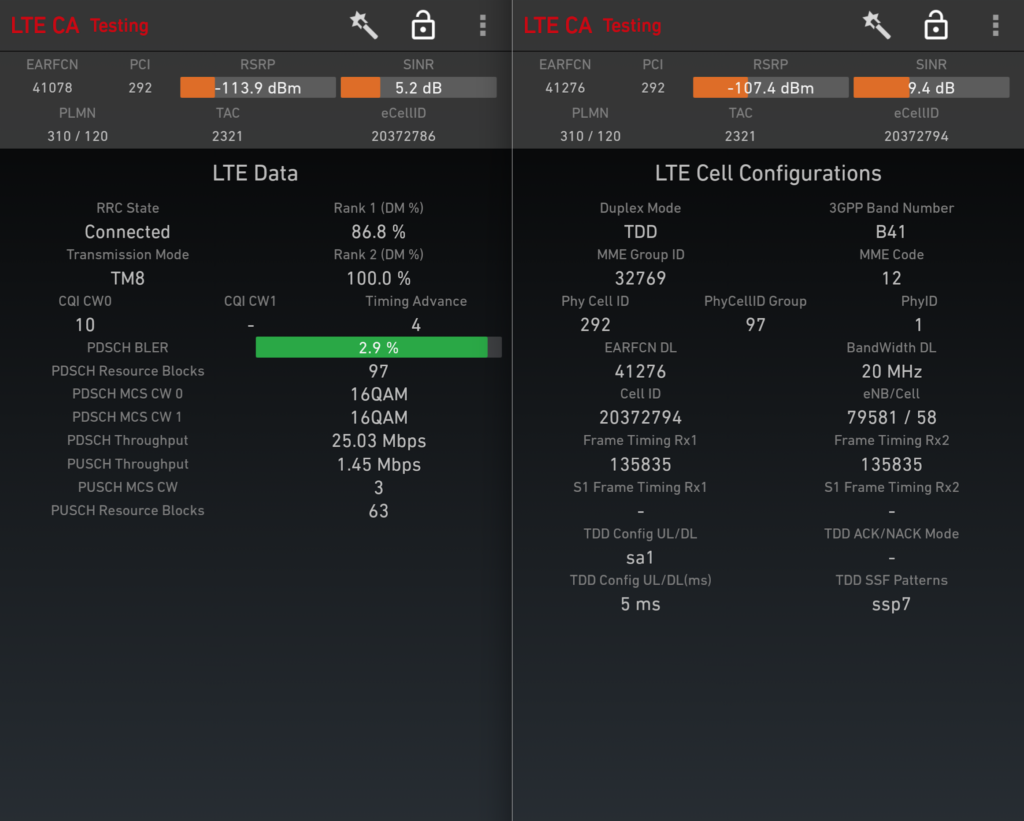

We are aware that Sprint is also trying to deploy a significant amount of Small Cells in New York market, but we haven’t seen much activity, likely due to zoning and permitting issues. With WiMax finally put to rest, Sprint has activated two contiguous 20MHz wide channels in the 2.5GHz TDD spectrum band, aggregated on about 1,000 cell sites across the market. However, a much greater issue lies in their overall cell site density, and the mix and match between Sprint’s Alcatel-Lucent supplied 8T8R and old legacy Clearwire’s (EDIT: Samsung in NYC market) dual-mode equipment. We are seeing a noticeable improvement in downlink throughput when connected to 8T8R cells, leveraging Dual-Layer Beamforming (Transmission Mode 8) which effectively extends the usable signal and is widely considered to be a must have feature for high-band TDD deployments around the globe. On the other hand, legacy WiMax/TDD LTE equipment, in some areas Huawei which Sprint had pledged not to use back in 2013, is still widespread and fall short of delivering any of these advanced features, making already small 2.5GHz cells even smaller and less efficient. From the user perspective this means that data rates are very inconsistent, anywhere from exceptional when in close proximity to 8T8R 2.5GHz cells, to falling back to Sprint’s FDD 5MHz (Band 25, 26) layers, or legacy CDMA, which are typically loaded and deliver less than stellar experience. Sprint has been using 8T8R term in marketing materials as early as 2013, and by now their network should’ve been fully blanketed with the best Alcatel-Lucent has to offer, but severe lack of funding and execution caused yet another compromise. Considering it’s the second half of 2016, we would at least expect from Sprint to showcase all its prowess in areas of the highest capacity demand in the world, like Times Square, yet we often connect to legacy Clearwire sites.

4×4 MIMO

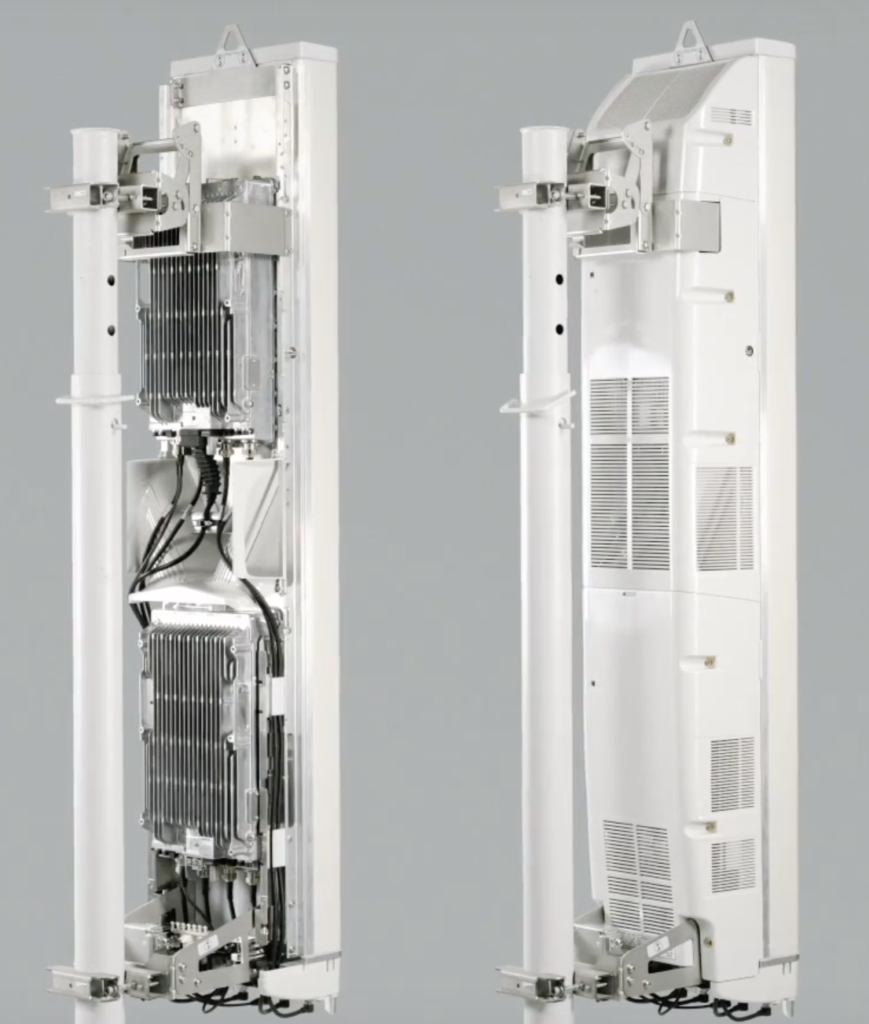

LTE infrastructure equipment with 4-way receive diversity has been around for quite some time. Added receive diversity enhances the link budget which is especially important for applications like VoLTE. On the flip side, doubling the amount of independent spatial streams from 2 to 4 on the transmit side therefore doubling the user downlink data rates by the way of 4×4 MIMO has yet to see the light of day. This delay is mostly due to challenges associated with designing and implementing two additional antennas into a handheld device, while maintaining high efficiency and low correlation. At the same time, most U.S. operators haven’t exactly been aggressive in getting ready for 4×4 MIMO rollout. One exception is T-Mobile in Nokia Networks (NSN) markets where 4×4 MIMO capable equipment, Flexi Multiradio 10 base station, has been fully commissioned since 2013. Additionally, there are some T-Mobile Ericsson major markets with 4×4 MIMO capable equipment, AIR32 and RRUS32, being deployed more widely at this time.

One particular sighting left us in absolute awe. At the Times Square T-Mobile Flagship store in Times Square, we’ve observed 4 Transmit (and receive) antennas on three active LTE channels, including the low-band! We aren’t aware of any other operator in the world, or a single capable device that could utilize 4 spatial streams on a low band just yet, but it goes to show how technologically ahead of the curve T-Mobile LTE network is, and how bullish they are when it comes to network efficiency and execution.

The most puzzling of them all is not only AT&T’s seemingly late and slow rollout of WCS spectrum, but that we are only seeing 4-way receive diversity rather than 4 Transmit 4 Receive configuration. This could be related to Alcatel-Lucent equipment capability and availability in the roadmap. Regardless, 4×4 MIMO on 2.3GHz WCS seems like a perfect match, and should be an excellent opportunity for AT&T to improve user experience in Manhattan during peak hours.

Verizon reportedly had 4×4 MIMO launch planned for 2016, but we have yet to come across a site reporting 4 transmit antenna configuration. We did observe sites with 4-way receive diversity, but is unclear whether the upgrade from 2×4 MIMO to 4×4 MIMO on ALU equipped sites requires a software upgrade, or additional hardware. We would imagine that Verizon is already looking into Nokia’s new 4×4 MIMO capable AirScale solutions.

During the Mobile World Congress 2016, Sony has demonstrated a pre-release 5.2” smartphone using Qualcomm’s Snapdragon 820 SoC with integrated X12 Cat 12/13 modem, achieving nearly 400Mbps over the air out of a single 20MHz channel with 4×4 MIMO and 256 QAM, which proves that at least one OEM has figured out the antenna design. We are expecting to see 4×4 MIMO capable smartphones making their way into the US market before the end of the year.

256 QAM

LTE standard allows for adaptive modulation techniques based on the reported channel state, adjusting the modulation accordingly. Up to 64 QAM (6 bits per symbol) is used on the downlink when a device reports favorable RF conditions, adding up to 50% incremental efficiency gain over 16 QAM (4 bits per symbol). Across our market, we’ve seen some of the highest 64 QAM utilization on T-Mobile’s LTE network, which we’re attributing to cell site density, deployed infrastructure, and potentially vendor specific software implementation.

256 QAM means sending even more (8) bits with each transmission, achieving incremental efficiency gain of up to 33% over 64 QAM. In simple terms, this translates to peak data rates of about 100Mbps (up from 75Mbps) per spatial stream in a single 20MHz LTE channel, meaning 200Mbps (up from 150Mbps) when using 2×2 MIMO, or 400Mbps when using 4×4 MIMO. But there are some challenges associated with 256 QAM deployments. Packing that many bits per symbol means that only a small percentage of devices with relatively high Signal to Interference + Noise Ratio (SINR) will be able to successfully process 256 QAM. As the device moves away from the cell center, SINR decreases and it becomes increasingly more difficult for devices to extract the usable signal and demodulate 256 QAM, therefore the less efficient modulation scheme is used. This is where sophisticated algorithms in our smartphone modems will be put to the test, as well as the network cell site density, discussed earlier.

When 3GPP standardized 256 QAM in Release 12 spec, common belief was that the only realistic 256 QAM use case would have to involve Small Cell application in an indoor environment where the SINR is high. But forward thinking infrastructure vendors like Ericsson took that idea to the next level developing ELC (Ericsson Lean Carrier) designed to improve SINR by minimizing chatty reference signal transmission from the adjacent cells. This makes 256 QAM macro deployment a reality, and major operators like Telstra already operate a highly efficient 256 QAM macro network in major urban markets like Melbourne. 256 QAM rollout doesn’t require any major capital investment, and it typically involves a simple software upgrade pushed by the vendor. Even if the operator initially sees only 10% of devices utilizing 256 QAM, that’s a huge 10% increase in overall spectral efficiency, and ultimately more available resources for the other 90% of the users.

The real question is why aren’t we seeing capable devices in the U.S. market?

Considering that nearly all flagship smartphones of 2016 have been powered by Qualcomm’s Snapdragon 820 SoC with X12 integrated modem capable of Category 12/13 speeds (600Mbps/150Mbps), 3CC Carrier Aggregation, and the capability to demodulate 256 QAM right out of the box, it’s unexplainable why some major OEMs have gone out of their way to ship variants with 256 QAM feature disabled (Samsung Galaxy S7, LG G5). What’s even more perplexing is major OEM like LG taking an extra step to ship their U.S. bound flagship product with 3CC Aggregation disabled, likely as a cost cutting measure. Assuming a 12-18 months device upgrade cycle, we simply can’t imagine operators being happy about this trend, knowing that a lower spectral efficiency of their networks ultimately translates to billions of dollars of unrealized profit. We acknowledge that OEMs or operators could potentially push a firmware update and enable higher order modulation in our existing Snapdragon 820 powered devices, but we won’t hold our breath. Disabling support for higher modulation scheme in flagship devices has left us scratching our heads, seeing that much smaller OEMs in China (LeEco Le Max 2, Asus ZenFone 3 Deluxe, Xiaomi Mi5) have been selling 256 QAM capable products with the same exact Snapdragon 820 SoC, at half the cost.

In order to experience 4×4 MIMO and 256QAM performance firsthand, we’ve placed a Snapdragon 820 Mobile Test Platform (MTP) unit in R&S TS7124 RF shielded box connected to the latest CMW500 by Rohde & Schwarz. Using a single over-the-air 20MHz LTE channel, downlink rates peaked at 391Mbps, uplink rates increased by 50%, the overall jump in spectral efficiency was simply staggering. Furthermore, with more antennas at the basestation and in the device, UE is likely to transmit at the lower power level when closer to the cell edge, and it’s also likely to transmit data more efficiently using higher MCS which contributes to better battery life. Signal robustness and Tx/Rx sensitivity drastically increases, driving even better end to end experience on applications like VoLTE. Considering that all of these capacity enablers have been readily available to operators, activating them on the network side would seem like a no-brainer.

Other equally important enhancements are Uplink Carrier Aggregation and Uplink 64 QAM. These enabling technologies are specifically important in TDD LTE deployments and are a software upgrade away. If Sprint can manage to deliver ubiquitous TDD coverage in major markets, these features could allow them to move from TDD Configuration 1 to Configuration 2, which will further increase the downlink data rates, and at the very least maintain the existing uplink data rates.

In future articles, we will be benchmarking the LTE performance of popular smartphones. Now back to Pokémon Go…

Ben Kinde • 10 years ago

awesome article! Thanks!

Parker • 10 years ago

This was a great read! In the future benchmarking articles, would you consider including a HiSilicon based device? I'd be interested to see how they compare to Qualcomm, Intel, and Samsung.

Milan M.P. • 10 years ago

Hi Parker, Thanks for your comment! Our goal is to benchmark as many different devices as possible, and we are in the process of reaching out to OEMs.

Pei • 10 years ago

great article... thanks for your efforts

Robots • 10 years ago

Great article; thank you. Can you comment on the software used to perform the tests or what the screenshots came from?

Milan M.P. • 10 years ago

Hi, As mentioned in the article, it's QualiPoc Android by Rohde & Schwarz. It's the best in class optimization and benchmarking tool, used in the industry. - You can find a lot more info by going to Rohde & Schwarz website: https://www.rohde-schwarz.com/us/product/qualipoc_android-productstartpage_63493-55430.html

Michael Elling • 10 years ago

When you combine: 1) Steve Jobs' sneaking the trojan horse of equal access (aka wifi offload) into the carrier silos in 2007, which really got the ball rolling for 3G, then app ecosystems, then 4G (so essentally all demand pull, not supply push) with 2) Ericsson's latest mobility report that shows video consumption on smartphones growing dramatically, while the portion going over wifi also increasing from 75% to 85%, thereby 3) implying that the carriers charge $1 for 15-30 cents of actual service delivered, and 4) this excellent piece of the spotty nature of 4G evolution, then one really has to wonder how 5G will ever come to market. Looks like we need another Steve Jobs catalytic moment.

Abhishek • 10 years ago

Please test Galaxy Note 7. As it is rumored to have 4x4 MIMO.

Alexander • 10 years ago

Milan, very detailed analysis, thank you! Eager to see end-user equipment tests. Do you plan to review performance of M2M/IoT networks? This is such a hot topic today. While all US operators stated their support of LTE Cat M1/Cat 1/Cat 0/NB-IoT stack it is interesting to see what's we have in the real world,

a d00d • 10 years ago

Thank you VERY much for the article! I came from from a TMoNews article, itself referencing a Reddit article, about the Note 7 having 4x4 MIMO, and this article contained far more. As for why carriers and phone makers keep disabling all the stuff under the hood, I'm guessing they're having some major problems making it work they haven't been able to figure out yet. Or, as you said, maybe it's simple cost cutting since most of these devices have locked down radios that will only work on that carrier's network. Perhaps someone from a carrier or a manufacturer could speak up anonymously and give us a definitive answer...

Mark • 9 years ago

Hi Milan. I think a lot of people are curious to know whether the 2 modem variants in the iPhone 7 (Qualcomm X12 vs Intel XMM7360) have any network performance differences on the T-Mobile or ATT network. Is this something you could test please? http://www.pcmag.com/news/347729/will-iphone-7-support-t-mobiles-new-400mbps-network There is also conjecture that Apple may have disabled 256 QAM on the Qualcomm models so as not to make the Intel models look inferior.

Maynard Handley • 9 years ago

"Assuming a 12-18 months device upgrade cycle, we simply can’t imagine operators being happy about this trend, knowing that a lower spectral efficiency of their networks ultimately translates to billions of dollars of unrealized profit." I understand your sentiment BUT here's what I don't understand. There is nothing stopping carriers from charging a higher price (or, if you prefer, offering a discount) to users based on their device technology. You could imagine a standard "spectrum efficiency usage" benchmark, and, based on your device's score on that benchmark, you get a discount on your cell bill. Right now the carriers can cry and whine all they like, but why should ANYONE care. All of the rest of us (OEMs and customers alike) have had to put up with their un-ending BS our entire lives --- we're damn well not going to do ANYTHING to help them just because they want us to. Since the carriers cannot change that toxic distrust that they have created, the only way they can improve this situation is by "technology-based pricing". Or, to put it differently, when they talk one thing, but refuse to enact that talk in any sort of pricing, I immediately dismiss whatever they are saying as non-serious...

Bart • 9 years ago

Thank you for writing this article, for putting together such a clean web site and for giving (arming even) the consumer information to help make a better decision as to which network and handset to choose.

Pooya • 9 years ago

Thanks, awesome study